What is Equity Trade Life Cycle?

Ever wondered what is the trade life cycle of equity in the capital market is like? How the stock market function and ensures everyone gets their traded shares? In this article, we will discuss briefly how the process of share distribution takes place between the company and investors.

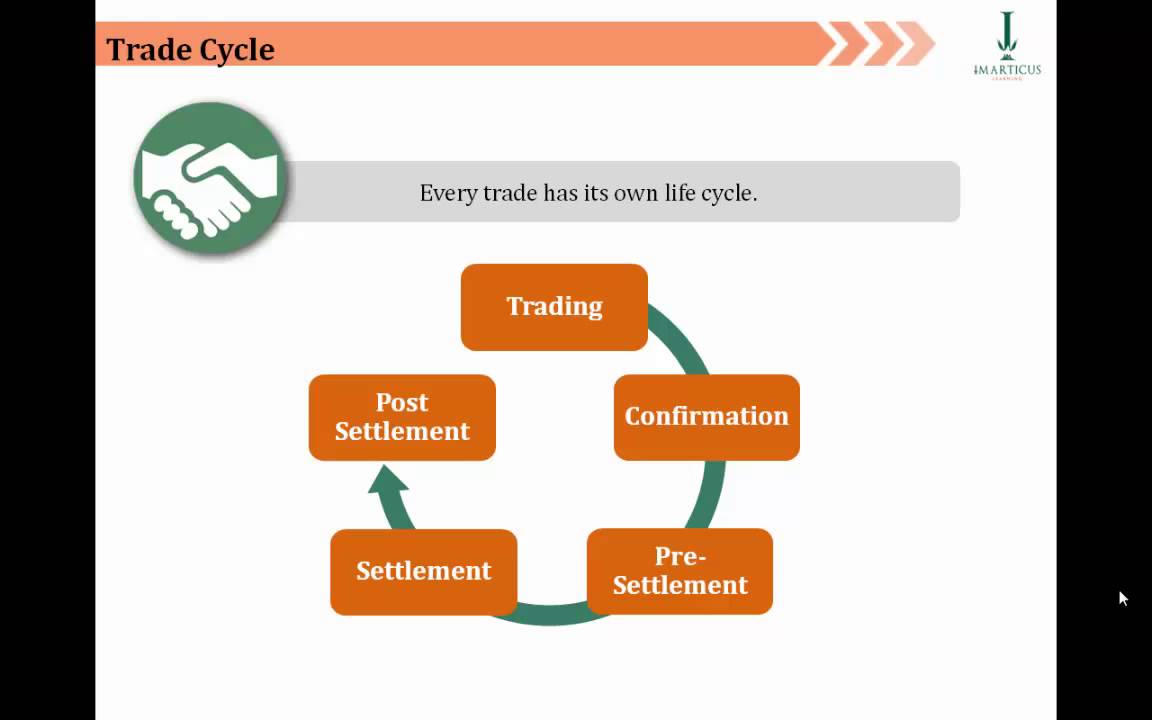

The life cycle of a trade in the capital market starts from the investor. An investor is a person or organization who is always in search of good investment opportunities and regularly invests in different financial assets like shares of a company, real estate, commodities, and bonds. The life cycle of equity consists of 6 steps, with the help of which an investor can receive his shares from the company.

Step 1: Placing the order with a broker firm

The investor finds an investment opportunity and plans to buy shares of a particular company. To which, they inform the broker firm to place a buy order from their side.

Step 2: The broker firm receives the order

The buy order of the investor is received by the sales trader at a brokerage firm. The traders will execute the order on behalf of the investor. The order is then sent to the risk management team for further processing of the equity trade order.

Step 3: The risk management team analyzes the equity trade buy order and proceed it further to the stock exchange

The risk management team analyzes the nature of the order and the risks evolved with it. After understanding the risks, the risk management team sends the equity trade order to an equity exchange platform. An equity trade exchange is simply a platform where the buyer and selling orders are matched and traded off.

Step 4: The exchange tries to match the buying order with a similar selling order and confirms the trader when a match is made.

Just like the investor, who is interested in buying the equity company in exchange for capital, there must be someone who wants to sell the equity in exchange for capital. The job of a stock exchange platform is to meet the demands of both investor and equity sellers and complete this trade. After a match is made, the exchange confirms the broker firm about the same.

Step 5: Trade confirmation and clearance of the order.

The exchange confirms the order on both sides: the investor side as well as the equity seller side. After this, the exchange gets to work and clearance house comes into the picture. The clearance house ensures the order is executed and transfers the equity to the investor as well as the capital to the equity seller. This is done in three terms:

- T: The transaction date of the equity trade order

- T+1: A day after the equity trade and when the securities are exchanged

- T+2: The day of clearance and settlement

Step 6: Settlement

This is the final stage of the equity trade life cycle in the capital market. It is where the funds are processed and sent to the respective investor’s account. We, at Imarticus Learning, believe in creating pioneers in the field of capital market trading by making them understand and practice the principles of finance in their lives.

Hi

ReplyDeleteYour article provides a great explanation of the equity trade life cycle, breaking down complex processes into simple, easy-to-understand steps. The role of data analytics in trade execution, clearing, and settlement is well-highlighted, making it a valuable resource for finance and data professionals. This is a must-read for anyone looking to understand market operations and how data analytics enhances efficiency in trading. Well done on creating such an insightful and informative piece!

ReplyDelete